When you’re buying a new car in Australia, you’ll often encounter the term ‘driveaway price.’ But what does this really encompass, and how does it fluctuate across different states and territories? This comprehensive guide aims to shed light on driveaway prices, outlining the various components that affect your total outlay depending on where you are. By understanding these distinctions, you’ll know exactly what you’re paying for when taking your new car onto Australian roads.

What is a Driveaway Price?

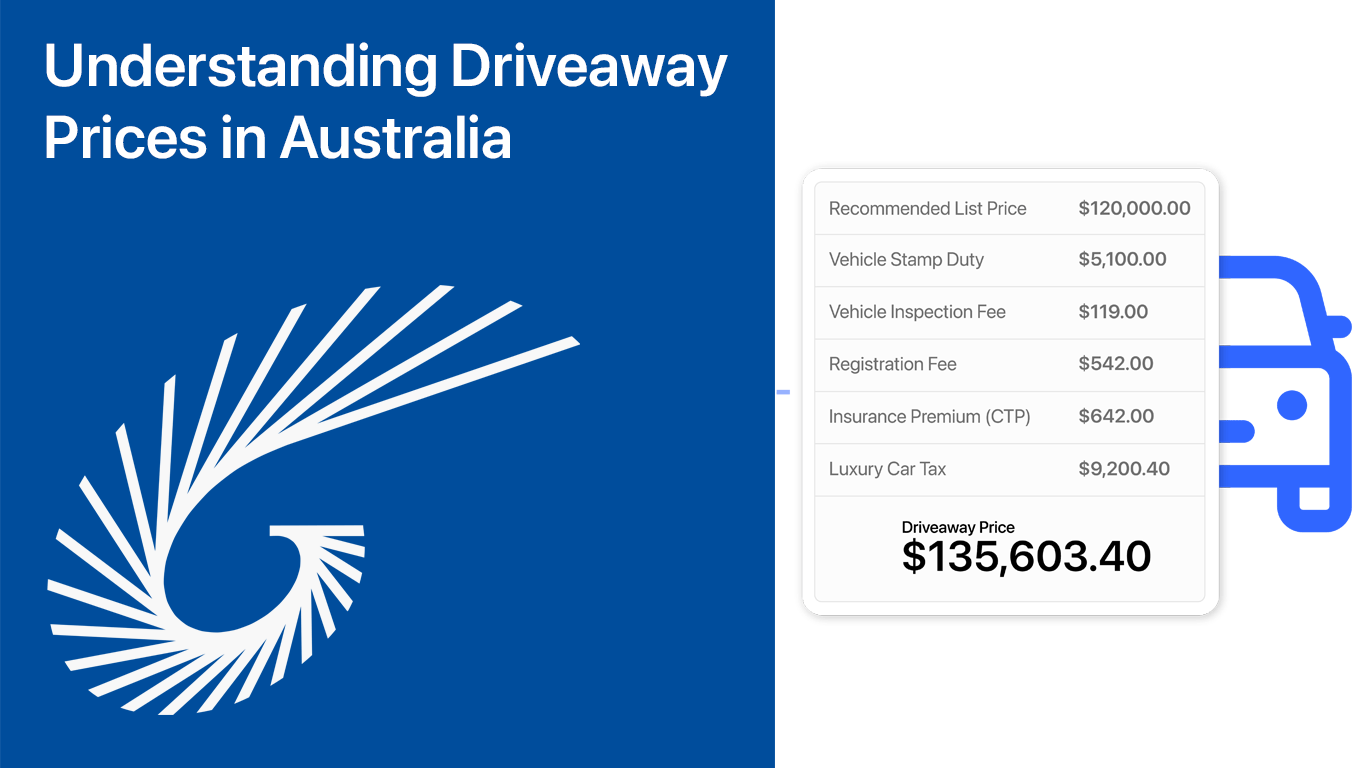

A driveaway price represents the final cost of purchasing a vehicle, including all fees required to get the car on the road. It goes beyond the base price of the car, accounting for essential fees such as car insurance, registration, and dealer delivery charges that allow your vehicle to legally operate on public roads. These charges vary based on location, but all serve the same purpose: to ensure that your car is roadworthy and compliant with local regulations.

Federal Components of Driveaway Prices

While fees can differ across regions, certain costs apply universally across Australia. One such component is the Luxury Car Tax (LCT), a federal tax imposed on vehicles that exceed a specified price threshold. This tax remains constant regardless of where you purchase your new car, so it’s important to consider it when budgeting for higher-end cars.

Luxury Car Tax (LCT): A nationwide tax affecting vehicles priced above a specific threshold. This tax is relevant across all Australian states and territories, adding a significant amount to the final price of luxury vehicles.

Learn more about how the Luxury Car Tax impacts your purchase.

State-by-State Breakdown: What Is Included in Driveaway Prices?

The composition of a drive away price can differ significantly between states. Below, we break down these variations to help you navigate the fees specific to each region, including charges like car insurance, vehicle registration fees, and dealer delivery costs.

Victoria (VIC)

When purchasing a car in Victoria, your driveaway price typically includes:

- Compulsory Third-Party Insurance (CTP), referred to locally as the Transport Accident Charge (TAC)

- Registration Fee

- Plate Fee

- Stamp Duty

- Luxury Car Tax (if applicable)

- Dealer Delivery Fee (if applicable)

The Transport Accident Charge (TAC) in Victoria is one of the most significant components of the driveaway price. It is essential as it covers personal injury costs for individuals injured in motor vehicle accidents. The Registration Fee varies depending on the vehicle type and location, while the Plate Fee is a standard charge applied when a vehicle is first registered. Luxury vehicles in Victoria are also subject to the federal Luxury Car Tax, which is charged on cars above a certain price threshold.

In addition, Victoria has specific stamp duties that apply to motor vehicle purchases. The stamp duty is calculated as a percentage of the car’s market value, which can increase your final driveaway price.

Learn more about car registration requirements in Victoria.

Western Australia (WA)

In Western Australia, you can expect your driveaway price to account for:

- Administration Fee

- Registration Fee

- Plate Fee

- Motor Injury Insurance (CTP)

- Stamp Duty

- Luxury Car Tax (if applicable)

- Dealer Delivery Fee (if applicable)

The Motor Injury Insurance (CTP) in WA is crucial for covering personal injury liabilities in the event of a car accident. WA’s Registration Fee is based on the weight of the vehicle, so heavier vehicles tend to incur higher costs. The Administration Fee is a small charge, but it adds up alongside other costs, making WA’s driveaway price a bit more complex.

Stamp duty is another vital consideration in Western Australia. This is a state tax on the purchase of a new car and is calculated based on the vehicle’s market value. The exact percentage varies depending on whether the car falls under a specific price threshold.

Explore the full process of buying a car in WA.

Tasmania (TAS)

If you’re purchasing a vehicle in Tasmania, the driveaway price will typically cover:

- Registration Fee

- Fire Levy

- Road Safety Levy

- Insurance/MAIB Premium

- Plate Fee

- Motor Tax

- Luxury Car Tax (if applicable)

- Dealer Delivery Fee (if applicable)

The Fire Levy is unique to Tasmania and helps fund fire services throughout the state. Along with the Road Safety Levy, these costs are a significant part of the total driveaway price, ensuring that vehicles contribute to the state’s public safety initiatives. MAIB Premiums (Motor Accidents Insurance Board) also form a part of the compulsory insurance requirement, covering injuries resulting from motor accidents.

Motor tax in Tasmania is generally based on the weight and number of cylinders in the vehicle, which can increase your driveaway price significantly for larger vehicles.

Learn about Tasmanian-specific car regulations.

Queensland (QLD)

In Queensland, the total driveaway price includes:

- Registration Fee

- Traffic Improvement Fee

- Compulsory Third Party (CTP) Insurance

- Stamp Duty

- Plate Fee

- Luxury Car Tax (if applicable)

- Dealer Delivery Fee (if applicable)

The Traffic Improvement Fee is a charge unique to Queensland that helps to fund traffic-related infrastructure projects across the state. This fee ensures that your vehicle contributes to the improvement and maintenance of Queensland’s extensive road network. The Registration Fee is calculated based on the number of cylinders in your vehicle, meaning cars with larger engines will face higher registration fees.

Learn more about car pricing components in Queensland.

Northern Territory (NT)

In the Northern Territory, driveaway prices are typically composed of:

- Registration Fee

- Plate Fee

- Admin Fee

- Stamp Duty

- Luxury Car Tax (if applicable)

- Dealer Delivery Fee (if applicable)

NT has a simpler fee structure compared to some of the other states, with the Registration Fee based on the vehicle’s engine capacity. Vehicles over a certain capacity limit incur higher fees. The Stamp Duty is also applied to vehicle purchases in the Northern Territory and, like elsewhere, is calculated as a percentage of the vehicle’s market value.

The Administration Fee in NT is a smaller cost, but it’s essential to factor it into your overall budgeting for the driveaway price.

Explore the car registration process in the Northern Territory.

New South Wales (NSW)

New South Wales driveaway prices include:

- Registration Fee

- Vehicle Tax

- Plate Fee

- Inspection Fees

- Stamp Duty

- Compulsory Third Party (CTP) Insurance

- Luxury Car Tax (if applicable)

- Dealer Delivery Fee (if applicable)

Vehicle Tax is a notable component in NSW, and its value depends on the size of your vehicle. Heavier vehicles incur a higher vehicle tax. Inspection Fees are mandatory in NSW and ensure that the vehicle meets road safety standards. These inspections must be carried out before registration, which adds to the overall driveaway price.

The Stamp Duty is calculated based on the purchase price of the vehicle, while Compulsory Third Party Insurance (CTP) covers personal injury liabilities resulting from vehicle accidents.

Explore NSW’s registration fees and charges.

Australian Capital Territory (ACT)

For those in the ACT, the driveaway price will encompass:

- Registration Fee

- Government Fee Component

- Compulsory Third Party (CTP) Insurance

- Stamp Duty

- Luxury Car Tax (if applicable)

- Dealer Delivery Fee (if applicable)

In the ACT, CTP fees vary based on your car’s engine size, with higher fees for more powerful vehicles. The Government Fee Component covers administrative costs associated with the registration process. Stamp Duty in the ACT is calculated based on the purchase price of the vehicle and adds to the overall driveaway cost.

In addition to standard fees, vehicles classified as luxury will incur the Luxury Car Tax, adding to the total price for higher-end models.

Learn what to expect when registering a vehicle in the ACT.

Conclusion

When buying a new vehicle, understanding the components that form your driveaway price is key to managing your budget. While certain fees like the Luxury Car Tax apply uniformly across Australia, many additional costs, such as vehicle registration fees and dealer delivery charges, are state-dependent, making it vital to consider these regional variations.

By knowing what goes into your driveaway price, you can better evaluate dealership offers and make informed decisions. Keep in mind that fees and charges may evolve over time, so always verify the latest information with local transport authorities.

By being informed, you’ll avoid unexpected costs and ensure that you’re getting the most competitive deal on your new vehicle.